A wholesale profit margin represents the percentage of profit a wholesaler earns from selling products to retailers, calculated using the formula Wholesale profit margin = (Selling Price – Cost Price) ÷ Cost Price × 100%. Although profit margins differ depending on the industry, product, and market conditions, wholesalers typically see margins ranging from 15% to 50%.

Understanding wholesale profit margins is the cornerstone of a successful B2B pricing strategy. Whether you’re launching your first wholesale channel or optimizing existing operations, knowing how to calculate and manage your margins directly impacts your bottom line and business growth potential.

In this comprehensive guide, you’ll learn:

- The exact formulas for calculating wholesale profit margins

- How to distinguish between margin and markup (and why it matters)

- Proven methods for setting profitable wholesale prices

- Strategies to increase margins without losing customers

- Tools to automate margin calculations for scale

This article serves both newcomers seeking foundational knowledge and experienced operators looking to refine their pricing strategies for maximum profitability.

>> Read more: How To Price Wholesale: Formulas & Tips To Set Up Wholesale Pricing

What Is Wholesale Profit Margin?

Wholesale profit margin represents the percentage of profit you earn on each product sold to retailers, distributors, or other businesses in your supply chain. It’s calculated by dividing your gross profit by your wholesale selling price, expressed as a percentage.

Unlike retail margins that factor in end-consumer pricing, wholesale margins focus on the profitability of B2B transactions. This distinction is crucial because wholesale operations typically involve:

- Higher volume orders with lower per-unit margins

- Longer payment terms (net 30, 60, or 90 days)

- Different cost structures and operational requirements

The key difference between margin and markup often confuses business owners:

Margin = (Selling Price – Cost) ÷ Selling Price × 100

Markup = (Selling Price – Cost) ÷ Cost × 100

Understanding this distinction prevents costly pricing errors that can erode profitability.

Wholesale vs Retail Margin – Explained

| Aspect | Wholesale Margin | Retail Margin |

| Definition | Profit percentage on B2B sales | Profit percentage on end-consumer sales |

| Typical Range | 15-50% depending on industry | 30-70% depending on category |

| Volume | High volume, lower margins | Lower volume, higher margins |

| Payment Terms | Net 30/60/90 common | Immediate payment typical |

| Customer Type | Businesses, retailers, distributors | End consumers |

Why Margin Matters for B2B Pricing and Business Growth

Precise margin management enables strategic business decisions beyond basic profitability. Companies with strong margin discipline can invest in product development, scale operations efficiently, and weather market fluctuations.

Consider a manufacturer selling widgets at $10 wholesale with a $6 cost basis. A 40% margin ($4 profit ÷ $10 price) might seem healthy, but without proper margin analysis, they might miss opportunities to optimize pricing for different customer segments or volume tiers.

Smart margin management also supports competitive positioning. Understanding your true margins allows for strategic price adjustments during market changes while maintaining profitability targets.

What Is a Good Profit Margin for Wholesale?

A “good” profit margin for wholesale depends on your industry, product type, and business model. In general, wholesalers operate on slimmer margins than retailers because they sell in larger volumes at lower per-unit prices. While retailers might aim for margins of 50% or higher, wholesalers typically see profit margins in the 15%–30% range.

A margin closer to 15% is common in highly competitive or commodity-driven industries where pricing pressure is high. On the other hand, if you sell specialized products, have strong supplier relationships, or add extra value (such as packaging, customization, or logistics support), margins in the 25–30% range are both realistic and healthy.

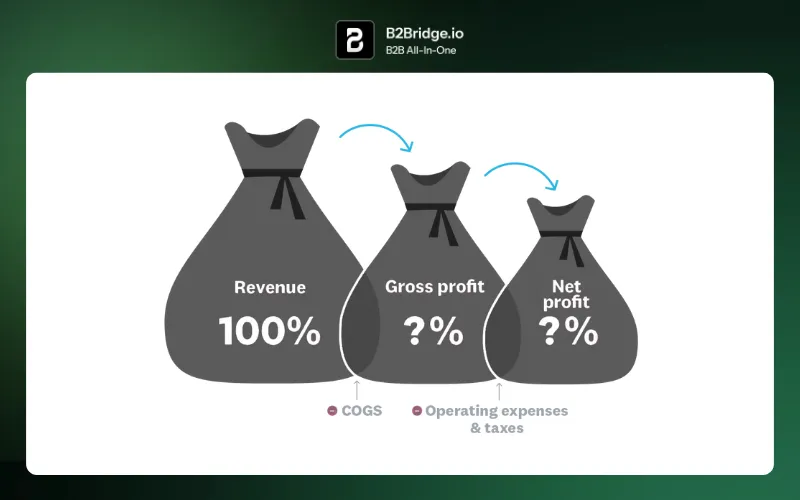

It’s also important to distinguish between gross margin and net profit margin. Gross margin only accounts for the difference between your wholesale price and cost of goods sold (COGS), while net profit margin factors in all other expenses like overhead, shipping, and marketing. A wholesaler may have a gross margin of 25%, but after operating costs, their net margin might be closer to 10%.

Wholesale Profit Margin Formula (With Examples)

Calculating wholesale profit margins requires precision to ensure accurate pricing decisions. Here are the essential formulas every B2B business needs to master.

Simple Wholesale Profit Margin Formula

Wholesale Profit Margin = ((Wholesale Price – Cost of Goods Sold) ÷ Wholesale Price) × 100

Variable breakdown:

- Wholesale Price = Your selling price to business customers

- Cost of Goods Sold (COGS) = Direct costs to produce/acquire the product

- Gross Profit = Wholesale Price – COGS

Markup vs Margin: Key Differences

Understanding both calculations prevents pricing confusion:

Margin Formula:

Margin % = (Gross Profit ÷ Wholesale Price) × 100

Markup % = (Gross Profit ÷ Cost of Goods Sold) × 100

| Cost | Wholesale Price | Gross Profit | Margin % | Markup % |

| $50 | $100 | $50 | 50% | 100% |

| $60 | $100 | $40 | 40% | 67% |

| $75 | $100 | $25 | 25% | 33% |

Notice how the same price points yield different margin and markup percentages. Using markup percentages when you mean margin can lead to significant pricing errors.

Step-by-Step Example Calculation

Scenario: You manufacture leather handbags with the following costs:

- Raw materials: $35

- Labor: $15

- Overhead allocation: $10

- Total COGS: $60

- Wholesale Price: $100

Calculation steps:

Step 1: Calculate Gross Profit

Gross Profit = $100 – $60 = $40

Step 2: Apply Margin Formula

Margin = ($40 ÷ $100) × 100 = 40%

Step 3: Calculate Markup (for reference)

Markup = ($40 ÷ $60) × 100 = 67%

This 40% wholesale margin means you retain $0.40 of every dollar sold, while the 67% markup indicates you’re selling at 67% above your cost basis.

How to Set Wholesale Prices: Proven Methods

Successful wholesale pricing combines cost analysis with market positioning and customer value considerations. Here are the most effective approaches used by profitable B2B companies.

Cost-Plus Method

The cost-plus method provides a straightforward foundation for wholesale pricing:

- Calculate total COGS including materials, labor, and overhead

- Determine target margin percentage based on industry standards and business goals

- Apply the formula: Wholesale Price = COGS ÷ (1 – Target Margin %)

- Validate against market conditions and competitor pricing

Example calculation:

COGS = $60

Target Margin = 35%

Wholesale Price = $60 ÷ (1 – 0.35) = $60 ÷ 0.65 = $92.31

Keystone and Absorption Pricing – Pros & Cons

Keystone Pricing (doubling your cost) offers simplicity but may not optimize profitability:

Pros:

- Simple calculation and implementation

- Ensures adequate margin coverage

- Industry standard in many sectors

Cons:

- May price products out of competitive range

- Ignores market demand and value perception

- One-size-fits-all approach misses optimization opportunities

Absorption Pricing factors in all business costs, not just direct COGS:

Use cases:

- High fixed-cost businesses (manufacturing, technology)

- Products with significant R&D investments

- Companies with complex overhead structures

Demand-Based & Differentiated Pricing

Smart wholesalers adapt pricing based on market realities:

Volume-based strategies:

- Higher margins for small orders

- Graduated discounts for larger volumes

- Minimum order quantities (MOQs) to protect margins

Segmentation approaches:

- Geographic pricing adjustments

- Customer tier differentiation

- Product category optimization

Example case: A electronics distributor implements tiered pricing with 45% margins for orders under $1,000, 38% margins for $1,000-$5,000 orders, and 32% margins for orders above $5,000. This strategy balances volume attraction with profitability protection.

Margin Targets by Industry

| Industry | Typical Wholesale Margin Range |

| Apparel & Fashion | 40-60% |

| Electronics | 15-25% |

| Food & Beverage | 20-40% |

| Home & Garden | 35-50% |

| Health & Beauty | 45-65% |

| Automotive Parts | 25-35% |

| Books & Media | 45-55% |

These ranges provide benchmarks, but your specific margins should reflect your unique value proposition, operational efficiency, and market positioning.

Free Wholesale Profit Margin Calculator

Use our calculator online that automatically calculates margins, markup, and break-even points for single products or entire catalogs.

Template features:

- Instant margin and markup calculations

- Volume discount scenario modeling

- Break-even analysis

- Profit projection charts

How to use for multi-product catalogs:

- Input product costs in the designated columns

- Set target margin percentages

- Review calculated wholesale prices

- Adjust for market positioning and competitive factors

- Export final pricing for your sales team

WHOLESALE PROFIT MARGIN RESULT

–

–

–

–

For businesses managing hundreds of SKUs, automated margin calculation becomes essential. Manual calculations increase error risk and slow down pricing updates needed for competitive responsiveness.

Top 6 Strategies to Increase Wholesale Profit Margins

Boosting wholesale margins requires strategic thinking beyond simple price increases. Here are proven approaches that maintain customer relationships while improving profitability.

Streamline Operations and Cut COGS

Operational efficiency directly impacts margin improvement:

- Automate repetitive processes to reduce labor costs

- Negotiate better supplier terms through volume commitments

- Optimize inventory turnover to reduce carrying costs

- Implement lean manufacturing principles where applicable

Real impact: A furniture wholesaler reduced COGS by 12% through supplier consolidation and automated order processing, increasing margins from 32% to 41% without price changes.

Optimize Inventory and Avoid Overstocking

Poor inventory management erodes margins through:

- Excess carrying costs

- Obsolescence and write-offs

- Cash flow constraints

- Storage expense increases

Optimization tactics:

- Implement demand forecasting systems

- Establish automatic reorder points

- Create SKU performance dashboards

- Develop clearance strategies for slow-moving inventory

Implement Tiered Pricing and Quantity Discounts

Strategic volume pricing protects margins while encouraging larger orders:

Example tiered structure:

- 1-50 units: 45% margin

- 51-200 units: 40% margin

- 201+ units: 35% margin

This approach increases average order value while maintaining healthy margins across all customer segments.

Improve Customer Retention & Loyalty Programs

Acquiring new wholesale customers costs 5-7 times more than retaining existing ones. Loyalty-focused strategies include:

- Extended payment terms for reliable customers

- Volume rebate programs encouraging annual commitments

- Exclusive product access for top-tier customers

- Co-marketing support adding perceived value

Negotiate Better Supplier Terms

Supplier relationship optimization can significantly impact COGS:

- Early payment discounts (2/10 net 30 terms)

- Volume commitment pricing for predictable orders

- Consignment arrangements for high-value items

- Direct shipping to reduce handling costs

Enhance Brand Perceived Value

Value perception supports premium pricing:

- Product quality improvements that justify higher prices

- Superior customer service differentiating from competitors

- Educational content and support adding customer value

- Packaging and presentation enhancements

Protect Your Pricing: Wholesale vs Retail Price Control

Maintaining separate wholesale and retail pricing channels prevents margin erosion and channel conflict. Exposing wholesale prices to retail customers creates several risks:

Pricing integrity risks:

- Retail customers expecting wholesale prices

- Channel partner dissatisfaction

- Brand value degradation

- Competitive disadvantage

Customer segmentation strategies:

- Implement gated access requiring business verification

- Use separate product catalogs for different customer types

- Apply account-based pricing showing relevant prices only

- Create private login portals for wholesale customers

Modern B2B Ecommerce platforms like Shopify offer built-in customer segmentation features that automatically display appropriate pricing based on customer tags and groups, eliminating manual price management complexity.

Wholesale Pricing for Bulk & Tiered Orders

Volume-based pricing requires careful margin analysis to ensure profitability across all order sizes. Here's how to structure tiered pricing effectively:

Setting minimum order quantities (MOQs):

- Calculate break-even points including fulfillment costs

- Determine target margins for different volume levels

- Create price breaks that encourage larger orders

- Communicate value proposition for each tier

Example tiered analysis:

| Order Quantity | Price Per Unit | Margin % | Total Profit | Fulfillment Cost Impact |

| 1-25 units | $45 | 45% | $506-$1,265 | High per-unit cost |

| 26-100 units | $42 | 40% | $436-$1,680 | Moderate efficiency |

| 101+ units | $38 | 35% | $1,343+ | Optimized fulfillment |

This structure encourages volume growth while maintaining acceptable margins across all tiers.

Automating Wholesale Profit Margin Calculations on Shopify (and Beyond)

Manual margin calculations become unsustainable as product catalogs grow. Automation provides accuracy, speed, and scalability benefits:

| Manual Process | Automated Solution |

| Time per SKU: 5-10 minutes | Time per SKU: Instant |

| Error rate: 3-5% typical | Error rate: Near zero |

| Update frequency: Weekly/monthly | Update frequency: Real-time |

| Scalability: Limited to small catalogs | Scalability: Unlimited SKUs |

| Integration: None | Integration: ERP, accounting, CRM |

Operational benefits include: • Reduced pricing errors preventing margin loss • Faster response to market changes • Consistent pricing across all sales channels • Automated margin reporting and analysis

For Shopify merchants managing B2B operations, specialized apps can automatically calculate and apply wholesale pricing based on customer groups, volume tiers, and margin targets, ensuring profitability while scaling operations efficiently.

Case Study: Brand Success with Improved Wholesale Margins

Background: A mid-sized kitchenware manufacturer struggled with inconsistent wholesale margins ranging from 15-55% across their 400-SKU catalog. Manual pricing processes led to errors and missed optimization opportunities.

Challenge: The company needed systematic margin improvement without losing key wholesale customers or competitive positioning.

Implementation strategy:

- Comprehensive COGS analysis revealing hidden costs

- Automated pricing system implementation

- Tiered pricing structure based on order volumes

- Customer segmentation for personalized pricing

Results after 12 months:

| Metric | Before | After | Improvement |

| Average Margin | 28% | 38% | +36% |

| Pricing Consistency | 55% variance | 8% variance | +85% |

| Order Processing Time | 45 minutes | 8 minutes | +82% |

| Customer Satisfaction | 3.2/5 | 4.1/5 | +28% |

Key quote: "Implementing automated margin management transformed our wholesale operations. We're more profitable, more competitive, and our customers appreciate the consistency and faster service." - Operations Director

The systematic approach to margin management resulted in $340,000 additional annual profit while improving customer relationships through better service delivery.

Advanced FAQ: Wholesale Profit Margin

A 30% profit margin is excellent in most industries. It reflects strong financial health and pricing power, as many businesses target around 20%. Achieving 30% means your business is performing at a very high level.

Whether 2% is “good” depends on your industry. Generally, 10% is considered healthy, 20%+ is strong, and below 5% may be risky. Use your margin as a guide - track it regularly, compare with benchmarks, and look for ways to improve.

Yes, a 70% profit margin is excellent. For many businesses - such as retailers, manufacturers, and restaurants - a gross margin between 50% and 70% is considered very healthy.

Typical wholesale margins range from 15-50% depending on industry, with most B2B businesses targeting 25-40%. Higher-margin industries like fashion and beauty can achieve 45-65%, while competitive sectors like electronics typically see 15-25%.

Include all direct costs in your COGS calculation: raw materials, labor, packaging, shipping to your warehouse, and allocated overhead. Then apply the standard margin formula using total COGS.

Not necessarily. Consider product-specific factors like demand elasticity, competition, and strategic importance. High-volume products might accept lower margins, while specialty items can command premium margins.

Review quarterly at minimum, with monthly reviews for fast-moving industries. Monitor cost changes, competitive pricing, and customer feedback to identify adjustment opportunities.

Extended payment terms (net 30, 60, 90) don't change margin calculations but do impact cash flow and carrying costs. Factor these costs into your overall pricing strategy and consider early payment discounts.

Next Steps: Optimizing, Protecting & Scaling Your Wholesale Margins

Margin management checklist:

- Monthly margin audits across all product categories

- Quarterly competitive price analysis for key SKUs

- Annual COGS reviews including supplier renegotiation

- KPI tracking for margin trends and customer profitability

- Automated alerts for margin compression indicators

- Regular customer feedback on pricing and value perception

Action steps:

- Use our free margin calculator to analyze your current profitability

- Implement customer segmentation to protect wholesale pricing

- Explore automation solutions for scaling margin management

- Set up margin monitoring dashboards for ongoing optimization

Ready to transform your wholesale operations with automated B2B pricing management? Get started with B2Bridge today and simplify your wholesale pricing - automate, customize, and scale with ease.

Discover how successful merchants are scaling profitably with integrated solutions that handle complex pricing, customer segmentation, and margin protection automatically.

Need help setting up smarter wholesale pricing? Contact our team today to see how B2Bridge can simplify your profit margin calculations and automate B2B pricing.

Hi, I’m Ha My Phan – an ever-curious digital marketer crafting growth strategies for Shopify apps since 2018. I blend language, logic, and user insight to make things convert. Strategy is my second nature. Learning is my habit. And building things that actually work for people? That’s my favorite kind of win.